Dear Fellow Tax payers! Let's make OSS easy and affordable!

Below you find step-by-step instructions on how to use OSSbuddy and how to create the OSS input for the ELSTER system.

Currently OSSbuddy works for Amazon transactions. Other platforms will be added step by step.

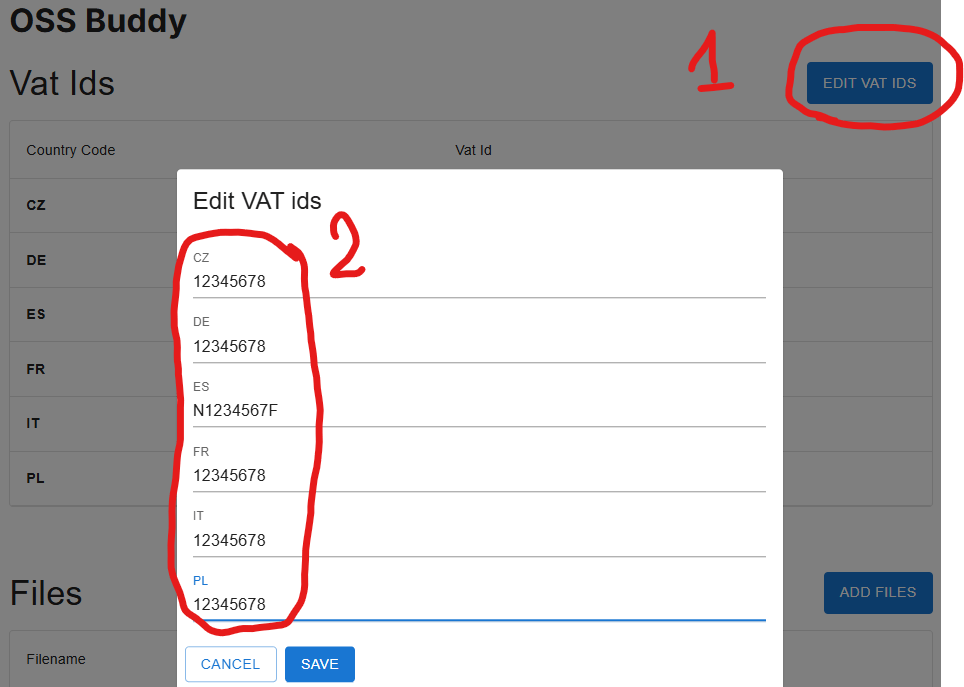

Click on EDIT VAT IDs and enter your company's VAT IDs with out the first 2 characters. Click SAVE to confirm.

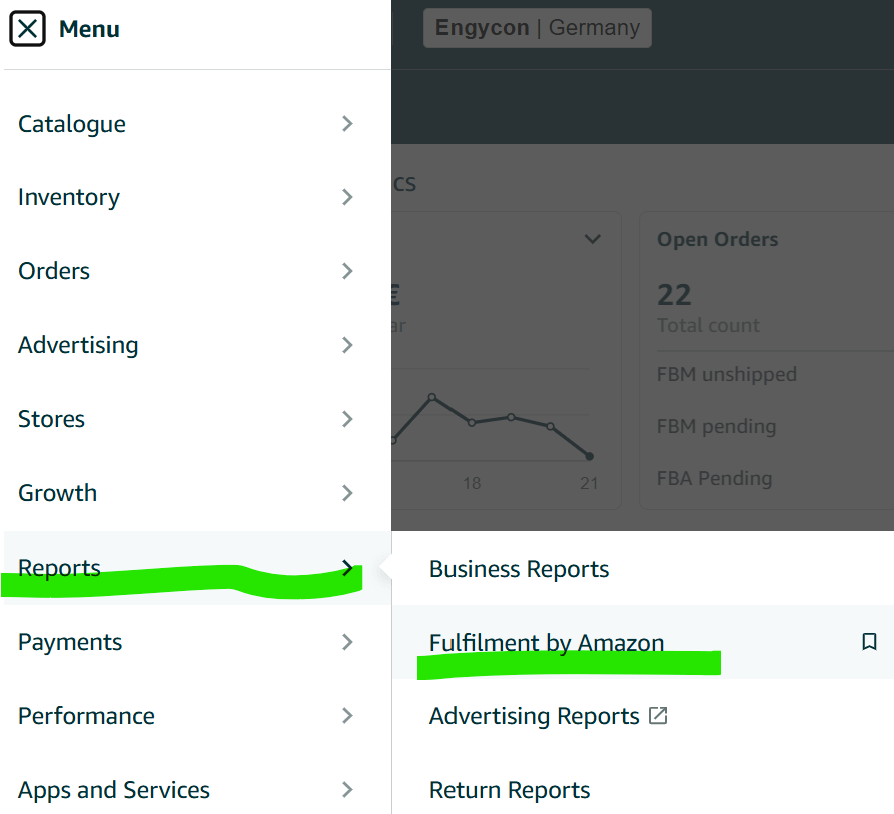

How to get the Amazon VAT transaction reports:

Go to your seller account to the left menu and select Reports / Fulfilment by Amazon

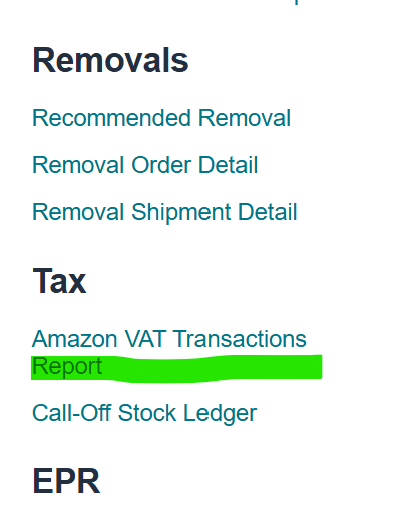

Choose Amazon VAT Transactions Report

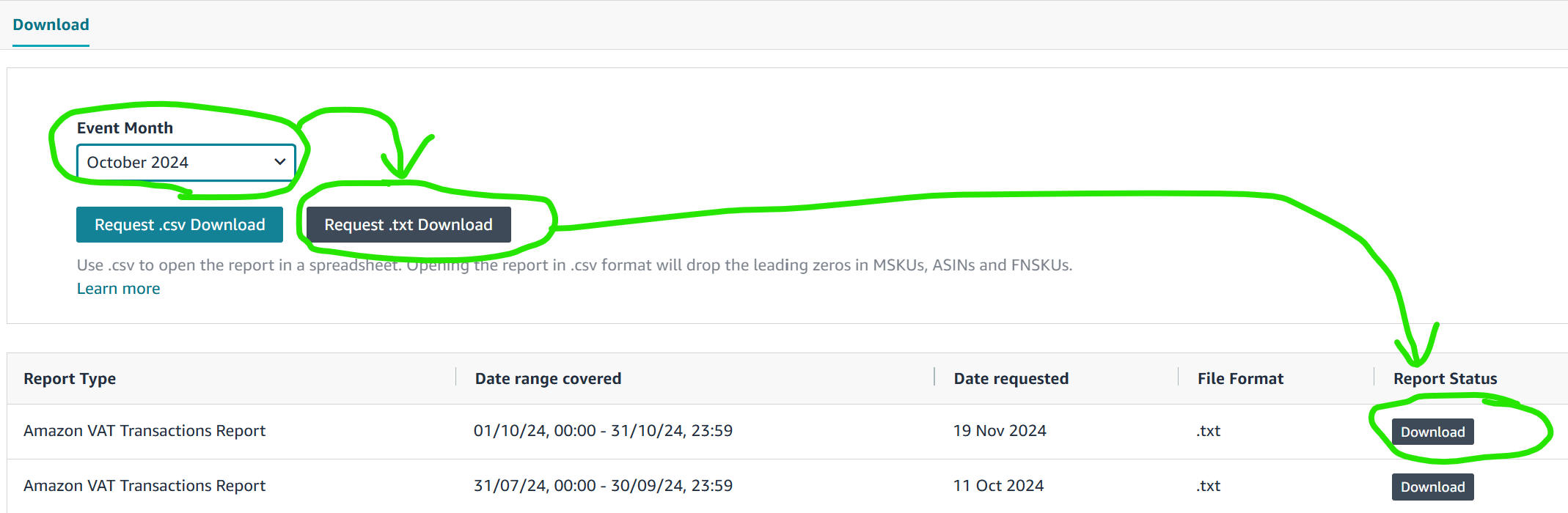

Choose the month and click Request .txt Download. The report will appear in the list of report after a small moment.

Then download the report.

Repeat for all month of the reporting quarter.

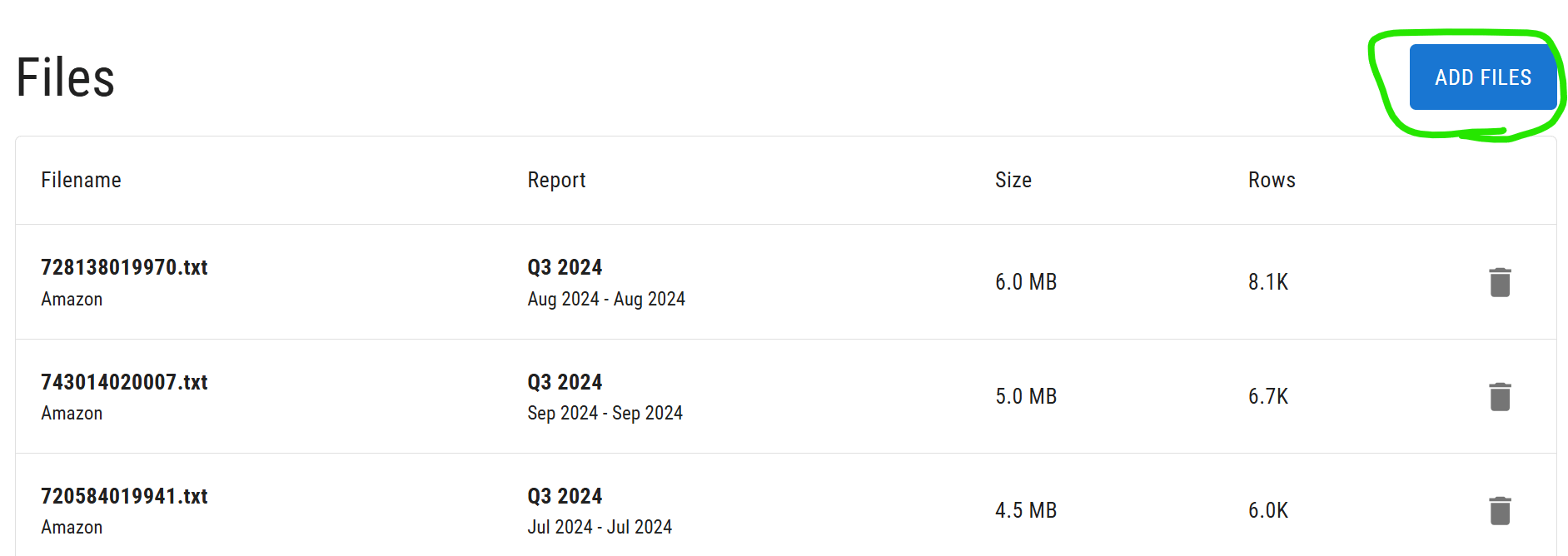

Then go to OSSbuddy and upload the Amazon VAT transaction reports by clicking on ADD FILES.

OSSbuddy will automatically detect the month and quarter the files belong to.

Make sure that each VAT transaction report has only uploaded once!

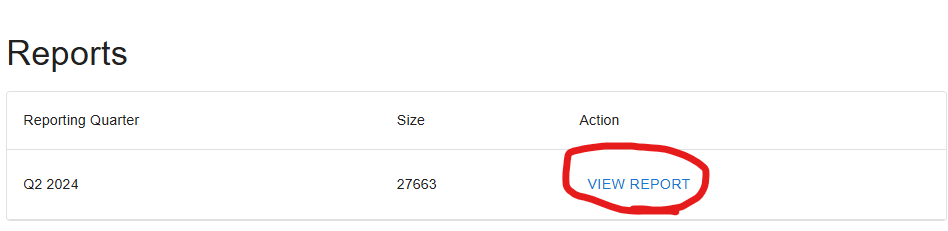

OSSbuddy will create the reports automatically and list them in the report section quarter by quarter.

Enter your reports by clicking on VIEW REPORT.

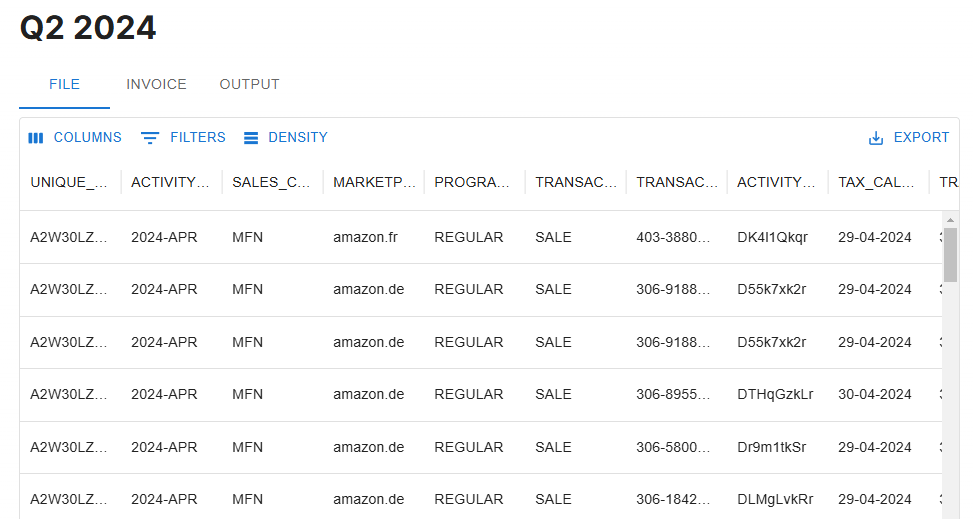

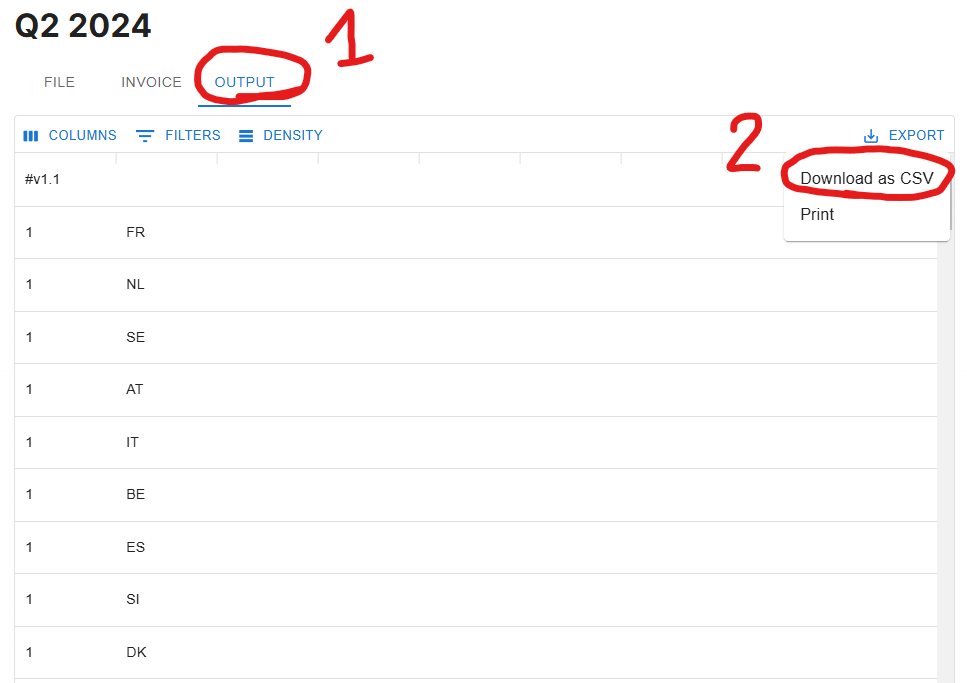

There are 3 Reports: All transactions / Invoice Report / OSS Output

Choose OUTPUT to visualize the OSS VAT report. This is the file that you will submit to the tax office through your Elsteronline account.

- Click on EXPORT and download the CSV file.

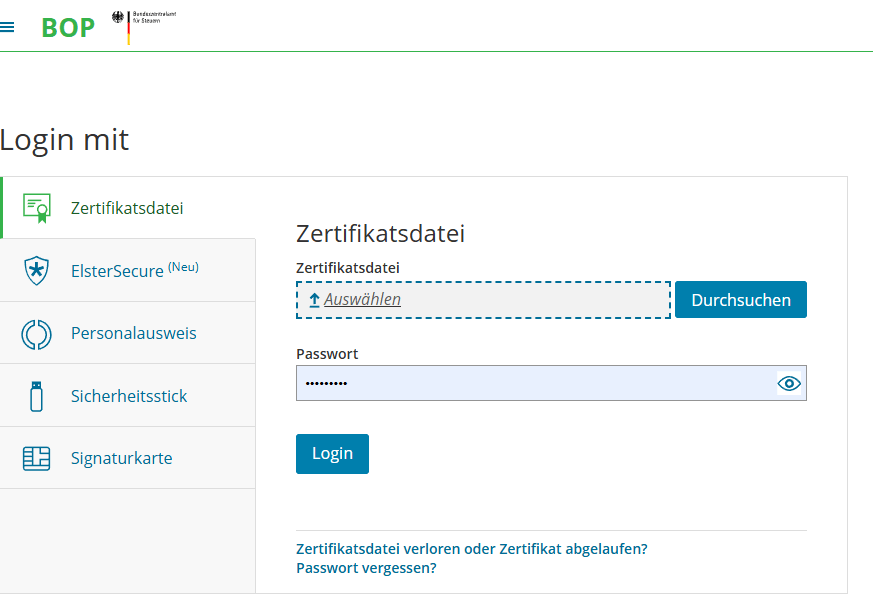

- Now go to Elsteronline and file your OSS VAT.

Bear in mind that the deadline for filing and paying the liable VAT amount is the last day of the month following the reporting quarter. For instance for 3rd quarter of 2024 the report must be filed and the payment be made by October 31st. - Link to the BOP Portal of Elsteronline: https://www.elster.de/bportal/login/softpse